We can help you expand your reach and get your jobs in front of the right candidates.

Sign Up NowGet started with the plan that fits your hiring needs.

Get started with the plan that fits your hiring needs.

Maximum Exposure to Fill Positions Fast

$ 299 /month

“We have found more quality candidates on Monster than we have on competitor sites”

Omni One – Marketing and Account Coordinator

“Monster makes it easy to reach a large, targeted candidate pool in a short amount of time.”

Healthcare Support – Manager, Systems & Contracts

“Monster means more than job postings for us. It’s their technology and support that really make them a true partner.”

Atkins – VP of HR, North American Sector

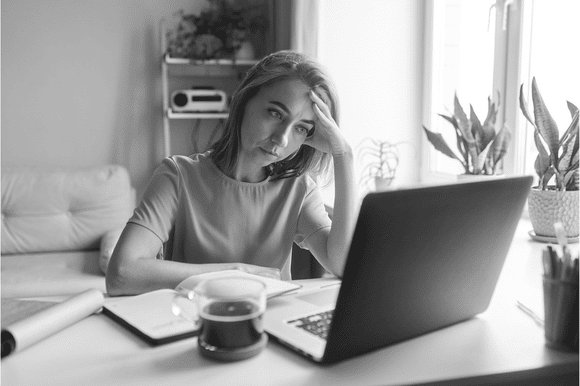

More than half of U.S. workers say they’re quiet quitters, but is it quiet quitting, or are you expecting too much?

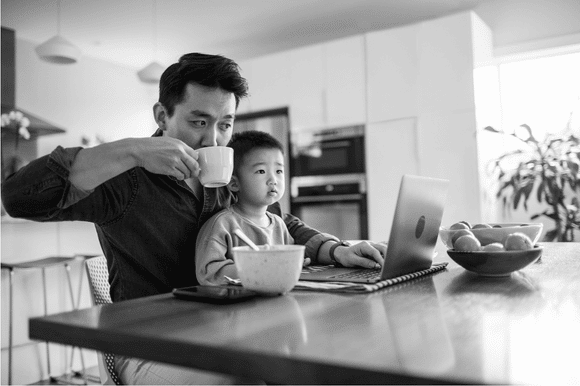

If you’re looking for ways to retain and support your talented parent and caregiver employees, you may want to consider offering new benefits to your valued parent and caregiver employees.

While fully in-person work has its benefits, many employers plan to stick with some form of flexible work, after two years of flexible work options, remote work may be a tough knot to unravel from company benefits.